Getting My Hard Money Georgia To Work

Wiki Article

Getting My Hard Money Georgia To Work

Table of ContentsHard Money Georgia - The FactsThe Best Guide To Hard Money GeorgiaA Biased View of Hard Money GeorgiaSome Known Facts About Hard Money Georgia.

The maximum acceptable LTV for a difficult cash lending is generally 65% to 75%. On a $200,000 house, the maximum a tough money loan provider would certainly be ready to offer you is $150,000.You can receive a difficult money funding extra swiftly than with a traditional mortgage lender, and the bargain can enclose an issue of days. Nevertheless, you'll pay a costs for that convenience. Difficult cash finances often tend to have higher rate of interest rates than conventional mortgages. As of January 2020, the ordinary passion price on a 30-year fixed-rate mortgage was 3.

By comparison, rates of interest on tough money car loans begin at 6. 25% but can go much greater based on your place as well as the residence's LTV. There are various other costs to bear in mind, also. Tough money lenders frequently charge points on your funding, sometimes referred to as origination fees. The factors cover the administrative expenses of the lending.

Factors are usually 2% to 3% of the funding amount. As an example, three factors on a $200,000 finance would certainly be 3%, or $6,000. You might need to pay more points if your finance has a higher LTV or if there are numerous brokers associated with the transaction. Some loan providers charge just factors and also no other charges, others have added costs such as underwriting charges.

8 Simple Techniques For Hard Money Georgia

You can anticipate to pay anywhere from $500 to $2,500 in underwriting costs. Some tough cash lending institutions additionally bill early repayment charges, as they make their cash off the rate of interest fees you pay them. That means if you settle the funding early, you might have to pay an extra charge, contributing to the car loan's cost.

This means you're most likely to be offered funding than if you got a standard home loan with a questionable or slim credit report. If you require cash rapidly for renovations to flip a residence commercial, a difficult money loan can provide you the cash you need without the hassle as well as documents of a typical home loan.

It's a method investors make use of to acquire financial investments such as rental residential or commercial properties without making use of a great deal of their very own properties, as well as difficult cash can be valuable in these situations. Although hard cash finances can be useful for actual estate investors, they must be used with care specifically if you're a novice to property investing (hard money georgia).

If you skip on your finance settlements with a tough cash loan provider, the repercussions can be serious. Some loans are personally ensured so it can harm your credit report.

Hard Money Georgia - Questions

To locate a reputable lender, speak with trusted realty agents or home mortgage brokers. They might be able to refer you to lending institutions they have actually dealt with in the past. Tough cash loan providers also often participate in actual estate financier meetings to make sure that can be a great area to get in touch with loan providers near you.Equity is the value of the home minus what you still owe on the mortgage. The underwriting for house equity loans also takes your credit score history as well as income right into account so they tend to have lower passion prices as well as longer repayment durations.

It can likewise be termed an asset-based car loan or a STABBL finance (short-term asset-backed bridge loan) or a bridge financing. These are acquired from its particular short-term nature as well as the demand for substantial, physical collateral, typically in the form of real estate building.

Hard Money Georgia - Questions

They are regarded as short-term swing loan and the major use instance for tough cash financings is in realty deals. They are thought about a "hard" money funding due to the physical property the realty building called for to protect news the loan. In the occasion that a customer defaults on the finance, the lender gets the right to presume possession of the building in order to recoup the loan sum.

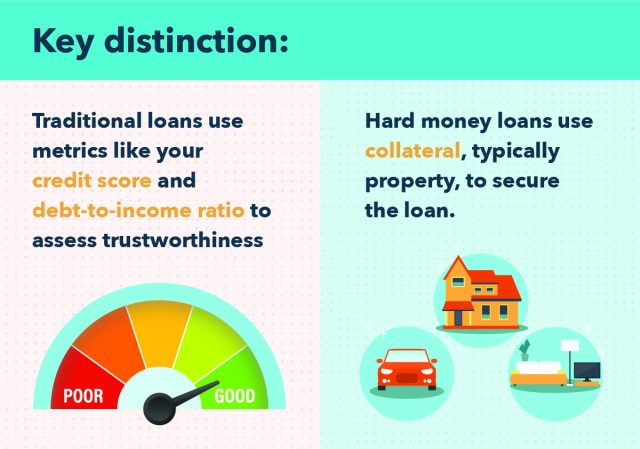

This is why they are mostly accessed by real estate entrepreneurs who would commonly call for quick funding in order to not miss out on out on warm opportunities. Furthermore, the lending institution mainly thinks about the worth of the asset or home to be bought rather than the customer's personal finance history such as credit history or income.

A standard Read Full Article or small business loan may use up to 45 days to shut while a hard money car loan can be enclosed 7 to 10 days, often faster. The benefit and rate that hard cash lendings offer continue to be a major driving force for why actual estate financiers select to utilize them.

Report this wiki page